:max_bytes(150000):strip_icc()/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

Discover the Advantages of Cooperative Credit Union Today

Credit scores unions stick out for their unique approach to monetary solutions, using a distinctive set of benefits that cater to their participants' demands in a manner that traditional banks typically battle to match. From customized client service to affordable rate of interest and a community-focused approach, lending institution supply a compelling option for people looking for more than just the typical banking experience. By discovering the advantages of cooperative credit union better, one can find a banks that prioritizes its members' economic well-being and aims to develop long-term relationships based upon trust fund and assistance.

Membership Benefits

Subscription benefits at credit score unions incorporate a spectrum of economic advantages and solutions customized to promote participant success and health. One substantial benefit of debt union subscription is the customized client service that participants obtain. Unlike standard financial institutions, cooperative credit union often prioritize structure strong relationships with their members, providing a more tailored experience. This can include financial counseling, aid with loan applications, and tailored suggestions to aid participants accomplish their financial objectives.

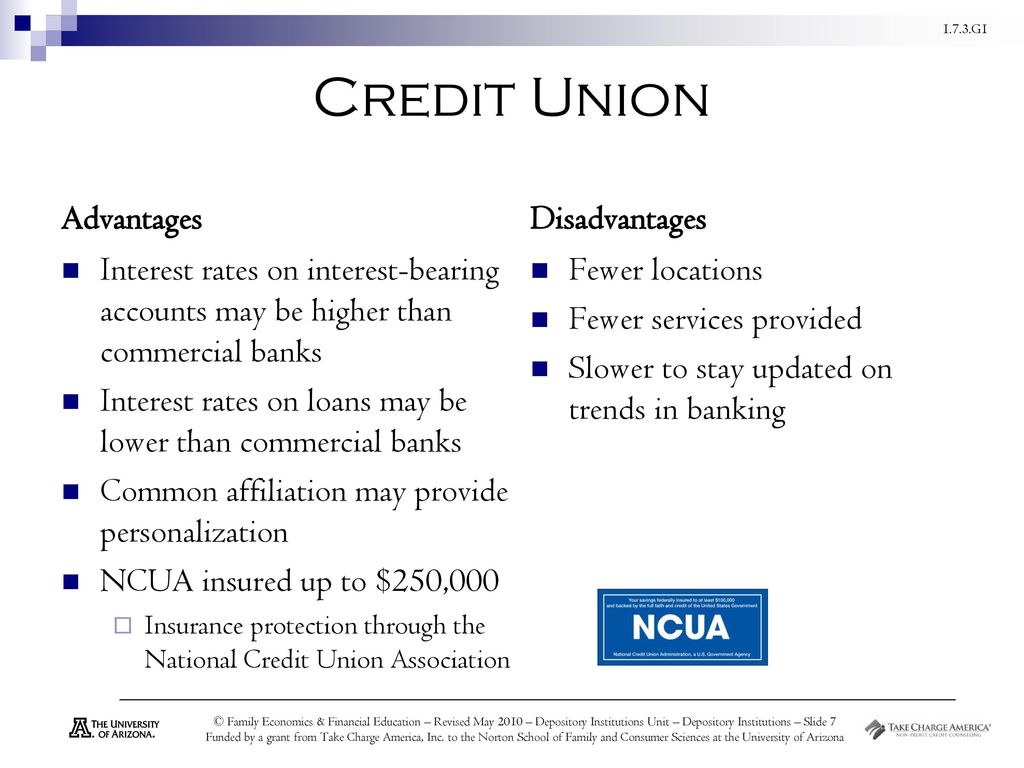

In addition, lending institution regularly give access to reduced interest rates on fundings, greater rate of interest on interest-bearing accounts, and reduced charges contrasted to bigger economic organizations. Participants can take advantage of these positive rates to save cash on car loans or expand their financial savings much more efficiently. In addition, credit history unions often use a variety of financial services and products, such as credit scores cards, home loans, and retired life accounts, all created to satisfy the varied needs of their participants.

Lower Fees and Better Fees

Credit scores unions attract attention for their dedication to providing lower costs and much better rates, straightening with their objective to supply participants financial advantages that typical financial institutions may not prioritize. Unlike financial institutions that intend to optimize revenues for shareholders, cooperative credit union are not-for-profit organizations possessed by their members. This framework permits credit rating unions to concentrate on offering their participants' benefits, resulting in reduced charges for solutions such as checking accounts, loans, and charge card. Additionally, lending institution often provide much more affordable rates of interest on interest-bearing accounts and fundings compared to traditional financial institutions. By maintaining fees reduced and rates affordable, cooperative credit union assist members conserve cash and accomplish their financial objectives more effectively. Members can take advantage of minimized expenses on essential economic services while earning greater returns on their down payments, making cooperative credit union a preferred option for those seeking helpful and economical financial remedies.

Neighborhood Involvement and Support

Energetic neighborhood participation and assistance are essential facets of cooperative credit union' procedures, showcasing their commitment to promoting local connections and making a favorable impact beyond monetary solutions. Unlike conventional banks, debt unions focus on community engagement by proactively taking part in regional events, sustaining philanthropic reasons, and supplying monetary education programs. By being deeply ingrained in the communities they serve, credit scores unions demonstrate a genuine commitment to boosting the well-being of their participants and the neighborhoods in which they operate.

With initiatives such as offering, sponsoring community events, and offering scholarships, credit report unions establish themselves as pillars of support for regional citizens. Credit score unions frequently collaborate with various other regional services and companies to resolve area demands properly.

Personalized Financial Providers

With a focus browse this site on meeting the distinct monetary needs of their members, lending institution supply personalized economic solutions customized to individual scenarios and objectives. Unlike traditional banks, lending institution prioritize constructing relationships with their participants to recognize their certain financial situations. This personalized approach allows credit unions to supply personalized options that straighten with participants' long-lasting purposes.

Lending institution offer an array of customized financial services, including tailored financial examinations, customized finance items, and individualized investment recommendations. By making the effort to comprehend each participant's financial objectives, credit report unions can supply relevant and targeted assistance to help them accomplish monetary success.

Additionally, cooperative credit union frequently provide individualized budgeting assistance and economic planning devices to aid members manage their cash successfully. These resources empower members to make informed financial decisions and job towards best site their preferred monetary results.

Improved Customer Care

In the world of economic organizations, the arrangement of outstanding client service collections lending institution aside from various other entities in the industry. Credit scores unions are recognized for their devotion to putting participants initially, supplying an extra individualized strategy to client solution contrasted to traditional financial institutions. One of the vital benefits of lending institution is the enhanced degree of customer support they offer. Members frequently have straight accessibility to decision-makers, allowing for quicker responses to questions and an extra customized experience.

Furthermore, debt unions usually have a strong focus on structure partnerships with their participants, aiming to understand their unique financial requirements and goals. This tailored focus can cause far better economic guidance and preferable product suggestions. Furthermore, cooperative credit union personnel are typically commended for their kindness, desire to help, and overall commitment to participant contentment.

Conclusion

Finally, credit unions offer a series of advantages including customized client service, lower charges, much better rates, and community involvement. By focusing on participant satisfaction and financial well-being, lending institution concentrate on offering their members' see here benefits and aiding them accomplish their economic goals efficiently. With a commitment to supplying affordable rates and individualized economic services, credit history unions continue to be a dependable and customer-focused alternative for individuals seeking economic aid.

By exploring the benefits of credit score unions even more, one can discover a financial organization that prioritizes its members' economic wellness and aims to develop enduring relationships based on count on and support.

Credit history unions commonly use a variety of financial items and solutions, such as credit cards, home mortgages, and retired life accounts, all designed to meet the varied requirements of their participants. - Credit Union Cheyenne

With an emphasis on satisfying the one-of-a-kind monetary demands of their members, credit scores unions provide individualized monetary solutions customized to individual situations and goals. By focusing on member fulfillment and economic wellness, credit rating unions focus on offering their participants' best interests and helping them accomplish their financial goals successfully.